Streamlined Cash Management

and Forecasting

Deliver transparency into company cash flow to facilitate future business plans

Treasury is a digital enhancement for operations such as loan management, SWAP, and cash balance reports. Treasury works with the support of the Accounts and Financial Reporting modules in smartPAL. The dynamic and interactive dashboard of the application is seamlessly integrated into a user-friendly environment with distinct visual presentations.

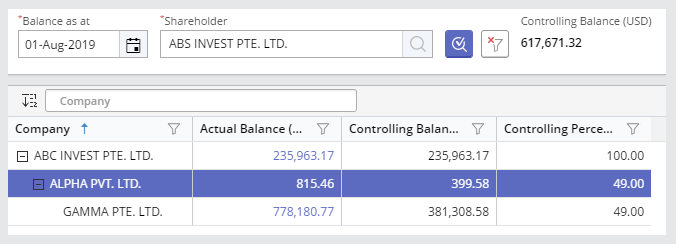

Keep track of the cash control balance of your companies

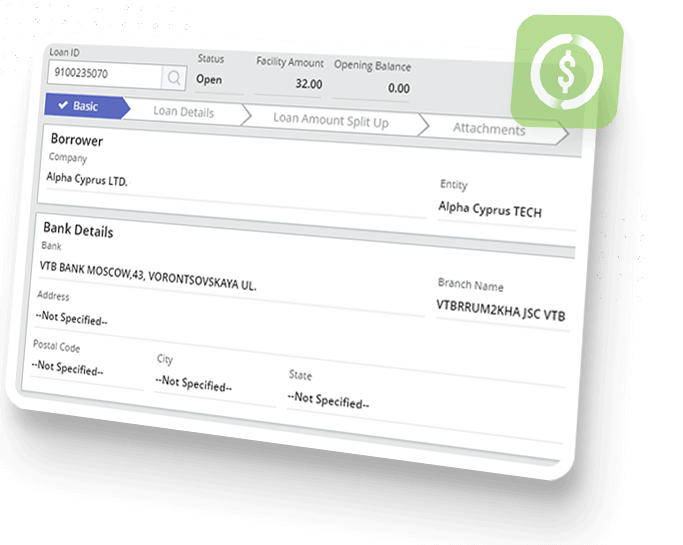

Complete loan management and record principal payments, interest repayments, accruals, loan charges, and more

Analyze loan to asset value ratio

Cash forecasting

Enhanced Financial Visibility: Provides clear visibility into the cash flow of the company, facilitating better financial decision-making and planning for future business initiatives

Efficient Cash Management: Streamlines cash control balance tracking, ensuring accurate monitoring and management of company finances

Comprehensive Loan Management: Enables thorough management of loans, including tracking principal payments, interest repayments, accruals, and charges, leading to improved financial management

Strategic Financial Planning: Facilitates cash forecasting, allowing businesses to predict and plan for future financial needs and opportunities more effectively

Other Products

Accounts

Accounts

Centralized management of financial accounting data, including currencies and charts of accounts.

Financial Reporting

Financial Reporting

Financial Reporting enables different types for configurations required for LiveFleet including alerts.

Frequently Asked Questions

To assist maritime businesses in maintaining liquidity and precisely planning future business moves, the smartPAL Treasury module centralizes cash management, loan tracking, and cash forecasting.

Improved cash flow visibility and unified financial control are provided by its smooth integration with Accounts and Financial Reporting, which guarantees real-time financial data synchronization.

By monitoring principal payments, interest repayments, accruals, and loan charges, smartPAL provides end-to-end loan management, guaranteeing accurate and transparent financial reporting.

Yes. The module provides information on financial leverage and solvency for better decision-making by automatically calculating loan-to-asset value ratios.

smartPAL supports strategic financial planning and budgeting across maritime operations by assisting in the prediction of future cash flow requirements through real-time cash forecasting tools.

The Treasury module ensures precise visibility into overall liquidity positions by offering real-time cash balance tracking across numerous companies and currencies.

Treasury professionals can swiftly make data-driven decisions thanks to the interactive dashboard's visual analytics for cash flow, loan schedules, and financial ratios.

Yes. Because of the system's SWAP management features, maritime businesses can manage currency and interest rate SWAP agreements on a single digital platform.

The module increases overall efficiency and accuracy by automating cash control and reconciliation procedures, which lowers manual labor, operating expenses, and financial inconsistencies.

The module gives management the ability to make strategic financial decisions and support long-term growth plans by providing total transparency of cash inflows, outflows, and loan obligations.